Top Digital Marketing for Real Estate Investors: Strategies that Work

Why Digital Marketing Matters for Real Estate Investors in 2026

Investor activity in residential real estate has surged dramatically since 2020, with some U.S. metros seeing investors account for over 25% of home purchases in early 2023. The pandemic accelerated remote deal hunting, making digital marketing essential for successful real estate investors in 2026. This guide focuses on data-driven strategies tailored for wholesalers, fix-and-flip investors, BRRRR buyers, small multifamily owners, and syndication partners, emphasizing personal branding and targeted prospecting for off-market deals and emerging markets, rather than traditional marketing aimed at retail home buyers.

Define Your Investor Strategy and Ideal Audience Before You Market

A marketing plan for a Phoenix fix-and-flip investor in 2026 looks completely different than one for a Columbus buy-and-hold investor or a 50+ unit syndicator. Before you spend a dollar on ads or write a single blog post, you need clarity on who you are and who you're trying to reach.

Common Investor Profiles

Consider which of these describes your focus:

Distressed single-family buyer: Targeting motivated sellers with properties needing work, typically pursuing wholesale or flip strategies

Small multifamily owner (5–20 units): Acquiring duplexes to 20-unit buildings for cash flow and long-term appreciation

Out-of-state turnkey buyer: Seeking stabilized rental properties in markets with strong rent-to-price ratios

Accredited LP for 100+ unit deals: Passive investor looking to deploy capital into syndications with experienced operators

Creating Your Ideal Customer Profile (ICP)

Your ICP should include concrete traits that guide every marketing decision; trait examples for defining your ideal customer profile include focusing on a specific market such as the Dallas–Fort Worth metro area, targeting properties within a price band of $150k–$350k after repair value (ARV), and specializing in property types built between 1970 and 1995, primarily single-family homes. The typical hold period may vary depending on strategy, ranging from 6–12 months for flips to 5 or more years for rentals. Risk tolerance is generally moderate, with investors willing to undertake cosmetic rehabs but avoiding major structural issues like foundation problems. Exit strategies often involve wholesale assignment or retail sale after renovation.

Questions to Answer Before Moving Forward

Before diving into tactics, answer these questions honestly:

Who is my motivated seller? (Probate, pre-foreclosure, tired landlord, out-of-state owner?)

Who is my buyer or tenant? (First-time homebuyers, Section 8 tenants, retail buyers?)

Who is my capital partner? (Private lenders, JV partners, accredited investors?)

Which specific markets and property types am I focused on?

What's my competitive advantage in this local market?

Build an Investor-Focused Website That Converts

It's 2026, and serious investors need a "home base" online—not just a Facebook page or BiggerPockets profile. Your website serves as the central hub where all digital marketing strategies drive traffic and conversions happen.

Three Core Audiences Your Website Serves

Your real estate business website likely needs to speak to multiple audiences:

Motivated sellers: Homeowners who need to sell quickly for cash

Private lenders and partners: Individuals looking to invest capital passively

Buyers and tenants: End buyers for your flips or tenants for your rentals

Essential Pages to Include

Home: Clear positioning statement (e.g., "We Buy Houses for Cash in Cleveland—Close in 14 Days")

"Sell Your House Fast in [City]": Dedicated landing page for seller leads with simple form

"Invest With Us": Explains partnership opportunities, return structures, and your track record

"Our Projects" or "Case Studies": Showcases recent deals with actual numbers

"About/Team": Builds trust through personal story and credentials

Trust Elements That Convert Visitors to Leads

Potential clients need clear proof that you're a legitimate and trustworthy real estate investor. To establish credibility, showcase recent deals with actual addresses and closing dates, such as "Closed: 123 Main St, Cleveland, June 2026." Including video testimonials from satisfied sellers or investment partners adds a personal touch and builds confidence. Additionally, provide proof of funds letters, ensuring sensitive information is redacted for privacy. Display membership logos from reputable organizations like local REIA chapters, the Better Business Bureau (BBB), and verified profiles on platforms like BiggerPockets. Complement these elements with before and after photos of completed projects to visually demonstrate your expertise and successful track record.

UX Best Practices

Your website must be user friendly for real estate leads who often search on mobile. This means implementing a mobile-first design since over 60% of searches happen on phones, ensuring fast loading times under 3 seconds, including click-to-call buttons on every page, using simple lead forms that collect only essential information such as name, phone, property address, and email, and placing clear calls-to-action above the fold to guide visitors effectively.

Tracking Infrastructure

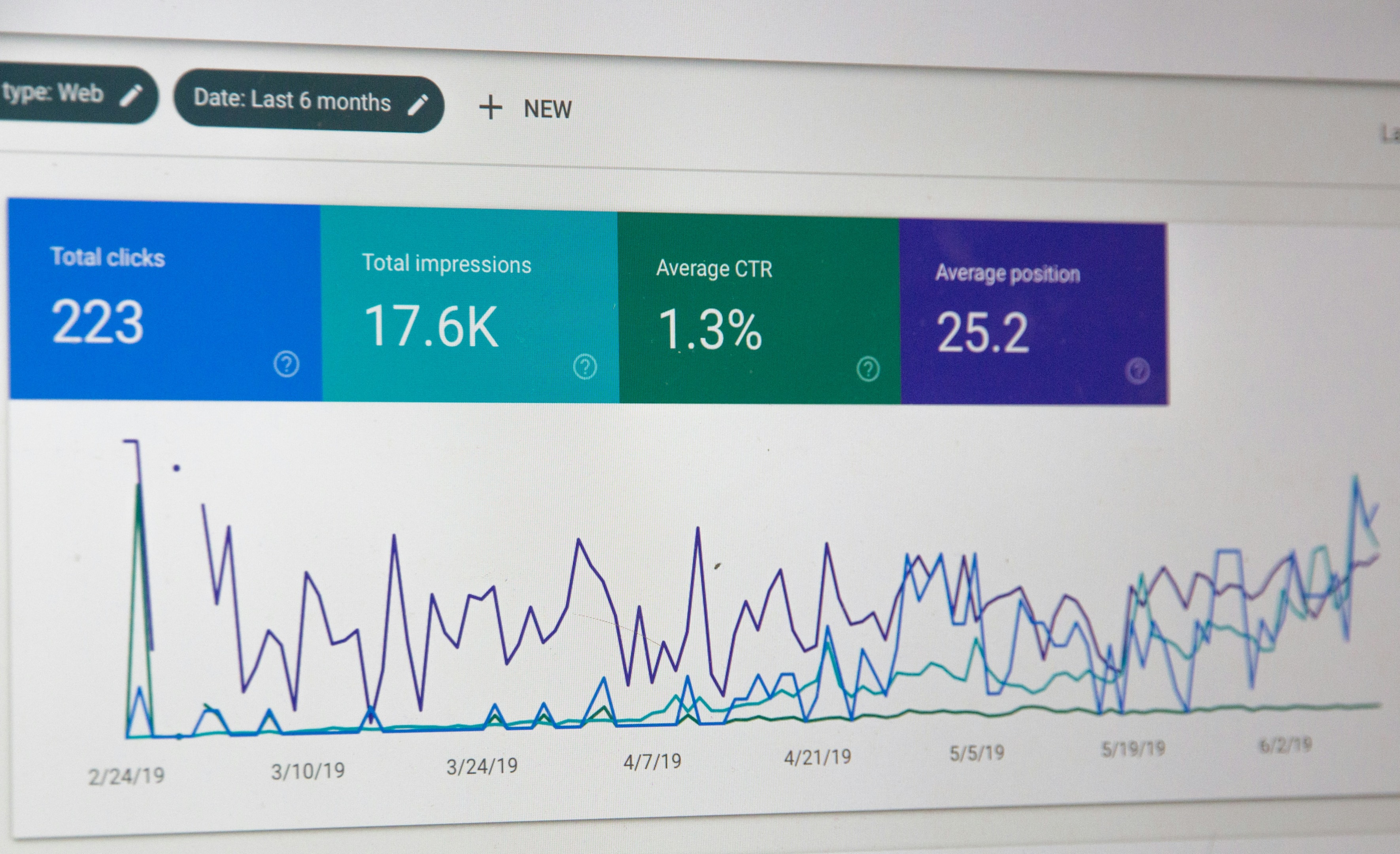

Before launching any campaigns, install essential tracking tools such as Google Analytics 4 (GA4), Google Tag Manager, and Meta Pixel. These tools enable you to measure critical actions like form fills, phone calls, and chat leads, providing valuable insights into which marketing channels generate leads and which ones may be wasting your budget.

Use SEO to Attract Motivated Sellers and Investor Partners Organically

Search engine optimization for investors is primarily about ranking for local "sell my house" and "investment property" keywords in specific cities. When home buyers start their search online, motivated sellers do the same—and you want to be the first result they see.

Keyword Themes to Target

Focus your content marketing on these types of search terms:

"sell my house fast in Memphis"

"cash home buyer in Milwaukee"

"investment property deals in Tampa"

"passive real estate investing in Austin"

"we buy houses [city]"

"avoid foreclosure [city]"

On-Page SEO Fundamentals

To improve search rankings, implement these basics on every page:

Use city + service keywords in H1 headings

Optimize meta titles and descriptions

Create clean URLs (e.g., /sell-your-house-fast-tulsa)

Add descriptive image alt text

Build internal links between related pages

Core SEO Pages to Create

Build out 6–10 search engine optimized pages:

Main service page ("We Buy Houses in [City]")

Separate pages for each city or submarket you target

FAQ page answering common seller questions

"How Our Process Works" explainer

Niche pages: "We Buy Inherited Homes," "Probate Property Buyers," "Pre-Foreclosure Help"

Local SEO Tactics

Local SEO is critical for investors targeting specific markets:

Google Business Profile: Ensure correct NAP (name, address, phone), select appropriate categories, upload photos of real properties, and collect verified reviews from actual sellers or partners

Local directories: Maintain consistent listings on Yelp, BBB, and local business directories

Location-specific content: Create neighborhood guides and market updates

Content Cadence

Aim to publish two to four blog posts per month that answer specific questions driving traffic, such as how long a cash sale takes in Atlanta in 2024, typical closing costs when selling to an investor in Phoenix, or whether to sell an inherited house or rent it out in Memphis. Consistent content creation compounds over time, allowing posts published today to generate leads for years with minimal maintenance.

Run Paid Ads Strategically to Find Deals and Capital

Paid ads through Google Ads, Facebook, and Instagram can generate leads much faster than organic SEO, but they require tight targeting and tracking to be profitable. The right audience combined with targeted ads can accelerate deal flow significantly.

Seller Lead Generation (Deal Flow)

For attracting motivated sellers, focus on intent-based Google Search campaigns:

High-intent keywords to target:

"sell house as-is Houston"

"avoid foreclosure Orlando"

"we buy houses Milwaukee"

"sell inherited house Dallas"

"cash home buyer near me"

For social media ads on Facebook and Instagram, use lead forms with copy that speaks directly to pain points, such as addressing those behind on payments in Detroit with a cash offer in 24 hours, or helping individuals who inherited a property in St. Louis in 2026 to skip repairs and sell quickly. Additionally, target tired landlords in Cleveland by offering to buy rentals with tenants in place. Running targeted ads on social media platforms enables you to reach potential buyers and sellers based on demographics, interests, and behaviors that indicate motivation.

Investor and Capital Attraction

For capital-raising, compliance matters. Instead of direct "invest now" pitches on digital ads, focus on promoting education-heavy content such as webinar invitations like "How We Underwrote a 14-Unit in Columbus—Live Deal Breakdown," downloadable guides including "5 Examples of 8–10% Cash-on-Cash Returns in Kansas City Small Multifamily (2019–2023)," and case study requests like "See How Our Investors Earned 12% Annually Over 3 Years." These approaches attract serious investors while maintaining regulatory compliance.

Campaign KPIs and Testing

Every campaign must have clear metrics:

For Google Ads, monitor cost per lead, cost per contract, and profit per campaign. On Facebook and Instagram, focus on cost per lead, lead quality score, and cost per closed deal. For SEO efforts, track organic traffic, form submissions, and phone calls. Email marketing metrics include open rate, click rate, replies, and deals attributed. For capital campaigns, keep an eye on cost per booked call and dollars committed per lead source.

Run basic split tests on:

Headlines ("Sell Fast for Cash" vs. "Get a Fair Cash Offer in 48 Hours")

Ad creatives (property photos vs. team photos)

Landing pages (long-form vs. short-form)

Leverage Social Media to Build Authority With Investors and Sellers

In markets like Phoenix, Tampa, and Charlotte, investors are using YouTube, Instagram, and TikTok to attract both sellers and partners—often more effectively than postcards. Social media marketing builds a strong online presence that compounds over time. For tips on getting into social media, especially if it's a new avenue for your business, read Essential Social Media Marketing for Real Estate Investors: Top Tips.

Platform Selection by Goal

Facebook groups are great for local networking, finding deals, and connecting with other investors. Instagram and TikTok excel at brand building, sharing quick tips, and reaching younger demographics. YouTube is ideal for deep-dive educational video content and property tours, while LinkedIn is best for connecting with accredited investors and commercial contacts.

Content Types That Perform

Video marketing consistently outperforms static images. Focus on these formats:

Before/after rehab stories: Include dates and actual numbers ("Purchased March 2024 for $85k, sold June 2024 for $145k after $22k rehab")

Deal breakdowns: Walk through purchase price, rehab costs, ARV, holding costs, and actual profit

Neighborhood spotlights: Analyze specific areas for investment potential

Day-in-the-life vlogs: Show the reality of being an investor

Q&A clips: Answer common questions about financing, due diligence, and market conditions

Posting Frequency Guidelines

To maximize engagement and build consistent online visibility, aim to produce three to five short-form videos per week across platforms like Instagram Reels, TikTok, and YouTube Shorts, complemented by one long-form YouTube video weekly. Additionally, share two to three story posts daily during active projects and maintain daily engagement in Facebook groups through comments and helpful answers.

Showcasing Numbers With Credibility

Real numbers build trust, but it's important to protect your deals by blurring addresses when needed, always mentioning the month and year, sharing realistic returns rather than exaggerated profits, and acknowledging deals that didn't go as planned to build credibility. Video testimonials from past flip partners narrating success stories, such as turning $150k into $250k profit in six months via short Reels, tend to perform well and gain algorithm favor on Instagram.

Email Marketing and CRM: Nurture Leads Until They're Ready

Most sellers and private lenders don't convert on first contact. Real estate investors need a simple system to nurture leads for months or even years until timing aligns. Email marketing combined with a proper CRM is the backbone of this follow-up machine.

Recommended CRM Platforms

Choose a CRM tailored to real estate investors. Popular options include Podio, which is highly customizable and favored in the investing community; REI BlackBook, designed specifically for real estate investors; and InvestorFuse, which focuses on lead management and follow-up. Additionally, general CRMs like HubSpot and GoHighLevel can be configured with investor pipelines. Your CRM should effectively categorize contacts as sellers, buyers, or capital partners, with different follow-up sequences tailored for each group. For a full list of the best CRMs for real estate investors, see How to Pick the Best CRM for Real Estate Investors (Without Wasting Money).

Seller Drip Sequence

A basic automated sequence for seller leads:

Email Marketing Sequence:

Welcome Email (Immediate): Explain how the cash offer process works and what sellers can expect.

Case Study (Day 3): Share a recent success story involving a similar property type.

FAQ (Day 7): Address common concerns about timelines and pricing.

Check-in (Day 14): Send a simple message asking if there are any questions, with an easy reply option.

Seasonal Email (Quarterly): Timed to coincide with distress events such as tax season or interest rate changes.

Investor/Partner Drip Sequence

For potential capital partners, focus on education by sending a welcome email that explains your investment thesis, followed by educational content about risk and return structures. Include deal structure explainers covering topics like debt versus equity, joint ventures, syndications, and promissory notes. Share recent project summaries with high-level numbers and invite them to schedule a call to discuss opportunities further.

Subject Line Examples

Strong subject lines drive open rates:

"How We Closed a Vacant Duplex in Cincinnati in 21 Days"

"Case Study: 14-Unit in Columbus Purchased December 2022"

"Quick Question About Your [Property Address]"

"What Happened to the House on Oak Street (Before/After)"

List Hygiene Best Practices

Maintain a healthy email list by regularly removing inactive contacts after six to twelve months of no engagement, segmenting your audience by interest such as seller, lender, or buyer, and including appropriate disclosures in capital-related emails. Always provide unsubscribe links and periodically verify email addresses to reduce bounce rates and ensure effective communication. For more tips on running a successful email campaign, see Email Marketing for Real Estate Investors: Strategies for Success.

Create Data-Backed Content That Attracts Serious Investors

Sophisticated investors look for data, not hype. Publishing numbers-based content builds trust and attracts higher-quality leads who can answer questions with actual analysis rather than speculation. This content marketing approach positions you as a one stop shop for local market intelligence.

Local Market Updates

Key metrics such as median days on market indicate how quickly properties are selling, reflecting market velocity. Typical rental yields demonstrate potential cash flow from rental properties, while inventory levels reveal the level of competition for deals in the market. Tracking price per square foot trends helps monitor patterns of property appreciation over time, and rent growth data validates assumptions about rental income increases. These metrics provide essential insights for real estate investors to understand market dynamics and make informed decisions.

Content Formats That Perform

Diversify your helpful information across formats:

Downloadable market reports: "2026 Birmingham Small Multifamily Snapshot"

Comparative blog posts: "East vs. West Nashville for Duplexes in 2025–2026"

Recorded webinars: Walk through actual deal analyses with screen shares

Data tables: Quick-reference cap rate comparisons by neighborhood

Video breakdowns: Explain market trends with visual charts

Time-Bound Data and Credible Sources

Include relevant information with specific timeframes, such as rent growth trajectories from 2019 to 2023, the impacts of interest rates between 2022 and 2026 on valuations, and comparisons of pre- and post-pandemic market conditions. Ensure to cite reliable sources including local MLS data, Census Bureau statistics, HUD reports, and major broker reports from firms like Marcus & Millichap and CBRE.

Transparency About Risk

Build trust by acknowledging downside scenarios such as vacancy assumptions at various rates (5%, 8%, 10%), renovation delay scenarios, interest rate sensitivity analysis, and exit strategy alternatives if market conditions shift. Investors appreciate realistic projections over rosy forecasts, and showing you understand risk makes your best-case scenarios more credible.

Repurposing Content Assets

These data-driven pieces can be repurposed for better performance across channels by summarizing them on social media sites as quick stats, using them as lead magnets for email list growth, referencing them in investor pitch decks, quoting them in podcast appearances, and sharing them in Facebook groups to drive traffic to your site.

Automation, Tracking, and Scaling What Works

Successful investors treat marketing like deal analysis: test, measure, and double down on channels that produce profitable deals or capital. Without tracking, you're guessing. With automation, you can scale what works without burning out.

Key Metrics to Monitor by Channel

Google Ads: Track cost per lead, cost per contract, and profit per campaign to measure advertising efficiency and profitability.

Facebook and Instagram: Monitor cost per lead, lead quality score, and cost per closed deal to evaluate the effectiveness of social media ads.

SEO: Focus on organic traffic, form submissions, and phone calls to assess the impact of search engine optimization efforts.

Email Marketing: Keep an eye on open rates, click rates, replies, and deals attributed to email campaigns for lead nurturing performance.

Capital Campaigns: Measure cost per booked call and dollars committed per lead source to gauge success in attracting investment capital.

Essential Automations

Start with these simple automations that create business growth without adding workload:

Instant SMS acknowledgment: New leads receive automatic text within 60 seconds

Email follow-up sequences: Triggered automatically based on lead source and type

Task creation alerts: CRM creates follow-up task if lead isn't contacted within 24 hours

Lead scoring: Automatic prioritization based on property details and motivation level

Attribution and Tracking Setup

Know exactly where your deals come from by using different call tracking numbers for each channel, such as Google Ads, direct mail, and SEO. Add parameters to all links to enable precise campaign tracking, monitor which landing pages convert best, and document the lead source on every contact in your CRM.

Quarterly Review Process

Schedule reviews every March, June, September, and December:

Pause underperforming ads: Stop campaigns with cost per lead above threshold

Reallocate budget: Shift spend to highest-converting channels

Update landing pages: Refresh based on actual conversion data

Test new audiences: Expand into adjacent demographics or neighborhoods

Review content performance: Double down on topics generating leads

Scaling Systematically

Once you have the fundamentals in place—a clear strategy, a converting website, consistent lead flow from SEO and online advertising, authority content, and a follow-up system—scaling becomes systematic:

Expand into new neighborhoods with proven templates

Target new price bands with adjusted messaging

Add asset classes (from single-family to small multifamily)

Replicate campaigns in new metros

Conclusion

Digital marketing for real estate investors isn't about chasing every shiny tactic or being everywhere online; it's about building a systematic approach that generates consistent deal flow, attracts the right capital partners, and positions you as the go-to investor in your local market. Start by defining exactly who you're targeting—your seller, your buyer, your capital partner—and build a website that converts visitors into leads. Layer in SEO for long-term organic visibility, paid ads for faster results, and social media to build authority. Use email and CRM to nurture leads that aren't ready today but will be ready in six months. The most effective ways to scale your real estate business in 2026 combines these channels into an integrated system where each piece reinforces the others. The investors closing more deals aren't necessarily working harder—they're working smarter with marketing systems that run in the background while they focus on acquisitions, renovations, and relationships. Pick one channel to master first, build the tracking infrastructure to know what's working, then expand methodically into new strategies, new neighborhoods, and new asset classes as your data tells you where the opportunities are. To learn more about the opportunities that exist in digital marketing, see Top Strategies in Digital Marketing for Real Estate Investing.